Table of Content

Our last article talked about home price affordability, this one talks about absolute home prices. A Federal Housing Administration loan is a mortgage that is insured by the FHA and issued by a bank or other approved lender. The immediate advantage of buying a home on the lower end of your price range is that you won’t need to bring as much cash to the table for your down payment. It’s also possible for a lower-priced house in a high-rate environment to be more affordable than a higher-priced house in a low-rate environment; it just depends on how the math shakes out.

This is made clear without the use of home price indices, fancy calculators, or algorithms…just take a look at some for sale listings and you’ll think home sellers are nuts for asking so much. But while interest rates remain cheap, there are great fears that they could rise substantially over the next year and beyond. Obviously, both are very important not only in terms of whether you should buy , but also with regard to how much house you can afford. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Read our editorial process to learn more about how we fact-check and keep our content accurate, reliable, and trustworthy.

Loading Data

The Fed is likely to keep hiking interest rates, which could lead to further mortgage rate increases. On the other hand, if the Fed’s actions lead to a recession, that could actually tug mortgage interest rates down. So it’s nearly impossible to predict what will happen to mortgage rates in late 2022 and 2023. Borrowers with good credit and strong finances often get mortgage rates well below the industry norm.

She has been in the accounting, audit, and tax profession for more than 13 years, working with individuals and a variety of companies in the health care, banking, and accounting industries. Stock buybacks have drawn criticism for using cash to benefit shareholders instead of boosting production or improving the quality of the business. What is also characteristic to share buybacks is their concentration. As we have seen in the second quarter this year, the top 20% of buybacks make up 47% of all repurchases across the S&P 500 Index.

Mortgage Rates vs. Home Prices: Is There Really an Inverse Relationship Between Them?

A 1% increase in mortgage interest decreases Johnny's purchasing power by $45,000. If the economy grows fast enough, rising mortgage rates will not have as great an effect on property value and housing prices, as long as salaries and wages correspondingly grow as well. However, if ARM rates exceed fixed rates in a couple years, it could mean you face higher mortgage payments when the 5/1 mortgage reaches the adjustable-rate period. So it’s important to be prepared for changes in mortgage costs when applying for a 5/1 ARM or other ARMs. Federal policy doesn’t directly impact rates on fixed-mortgages, but the central bank has some sway with 10-year Treasury yields, which do drive fixed mortgage movement.

In order to trade stocks around interest rates and upcoming interest rate decisions, traders need to be aware of the key economic dates in the calendar. This is when the significant volatility may occur in the stock market, so any stock trader will want to be aware of what’s happening, especially if speculating on short-term price movements. Check the DailyFX economic calendar to stay on top of potentially market-moving events.

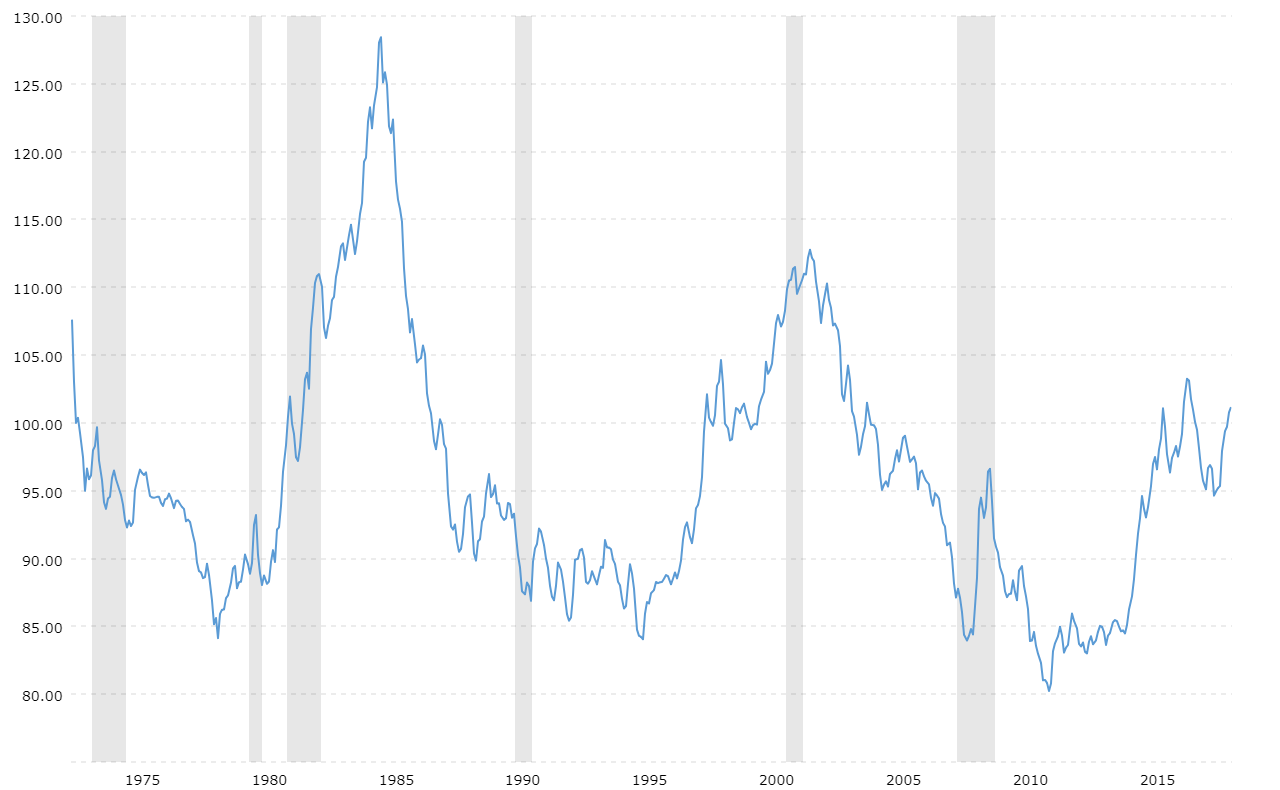

Historical Mortgage Rates: One Piece of the Puzzle

By capturing points and fees, the APR is a more accurate picture of how much the loan will cost you, and allows you to compare loan offers with differing interest rates and fees. Some analysts believe fixed mortgage rates might dip back into the 5 percent range in 2023. Before joining Bankrate in 2020, he wrote about real estate and the economy for the Palm Beach Post and the South Florida Business Journal. Data included in the press release are the number of new single-family houses sold; the number of new single-family houses for sale; and the median and average sales prices of new homes sold. Excluded from these estimates are "HUD-code" manufactured home units. In 2018, many economists predicted that 2019 mortgage rates would top 5.5 percent.

Your lender will be able to provide you with a line-item breakdown of your mortgage payment. Using a mortgage calculator is an easy way to find out what your monthly payments will be. You can also look at an amortization schedule, which shows you how much you’ll pay over time. In addition to your principal and interest payments, a monthly mortgage payment may also include several fees, like private mortgage insurance , taxes and homeowners association fees.

After five years, however, Johnny is on the hook for at least 7% interest, maybe more if interest rates spike. And of course, if you have a larger down payment, it will help you in all these factors for affording a home. The average APR on the 30-year fixed-rate jumbo mortgage is 6.83%. Compare refinance rates and do the math with Bankrate's refinance calculator. The cost of a point depends on the value of the borrowed money, but it's generally 1 percent of the total amount borrowed to buy the home.

And it kept falling to a new record low of just 2.65% in January 2021. A home mortgage is a loan given by a bank, mortgage company, or other financial institution for the purchase of a primary or investment residence. As with other historic data, you should contact prospective HOAs and ask for their rates over the last 10 years.

Because a home is typically the biggest purchase a person makes, a mortgage is usually a household’s largest chunk of debt. It’s important to prepare for the mortgage application process to ensure you get the best rate and most affordable monthly payments. Over the last 30 years, it was quite rare for mortgage rates to rise while house prices simultaneously dropped.

Essentially, neither a low house price nor a low-interest rate guarantees your best financial interest. It ultimately depends on the buyer’s circumstances and their ability to use them to their advantage. There is no guaranteed strategy to trade stocks based on interest rates and most traders choose to have a diversified portfolio in the effort of hedging against losses. When people have more disposable income to spend thanks to lower interest rates, the retail sector may get a boost. These are the rates charged on loans for consumers, such as a mortgage, or car finance. They may be based on bank rates, but they are independent and do not have to reflect recent changes.

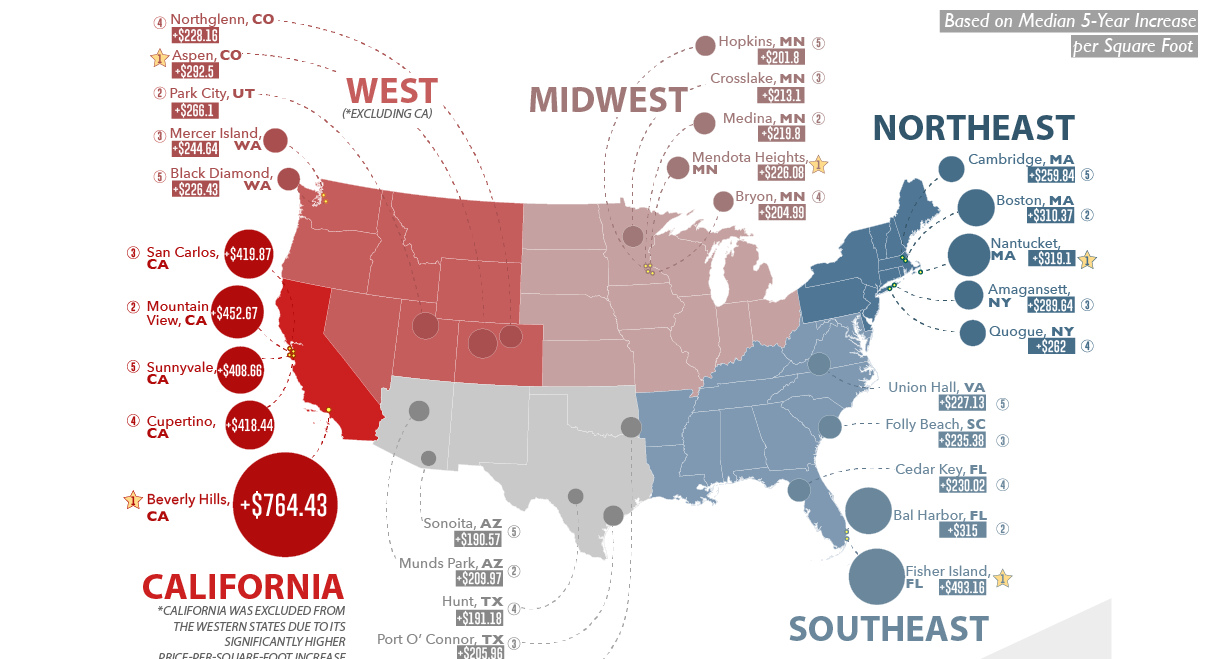

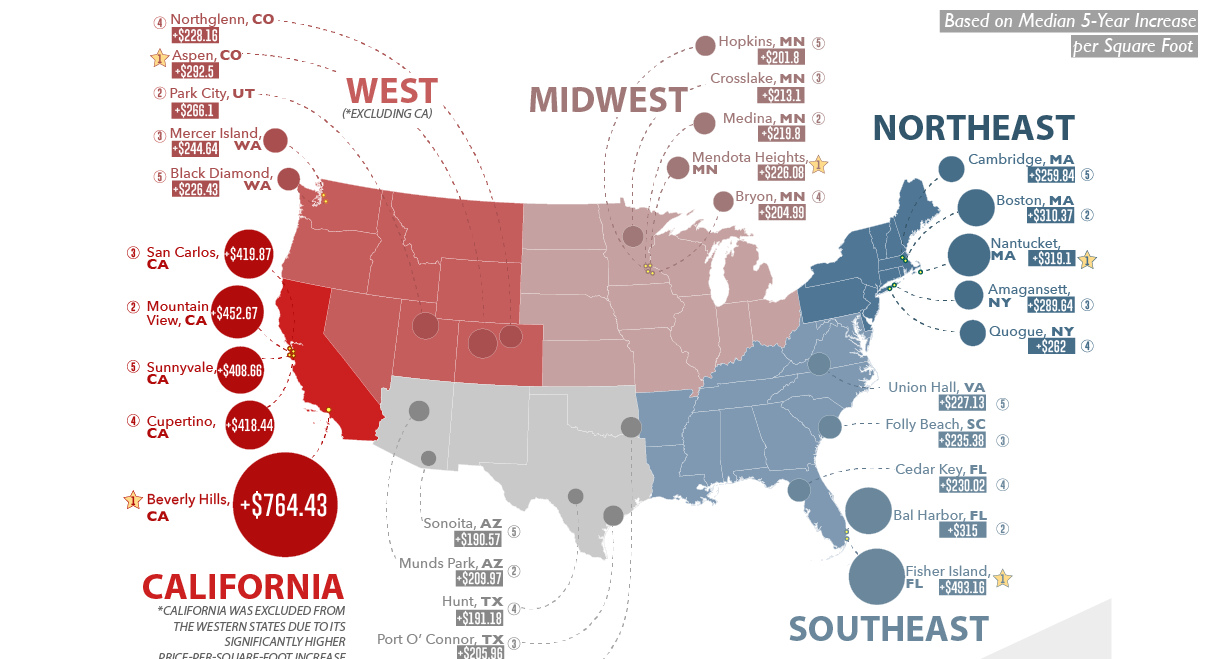

People who are buying their “forever home” have less to fear if the market reverses as they can ride the wave of ups and downs. But buyers who plan on moving in a few years are in a riskier position if the market plummets. That’s why it’s so important to shop at the outset for a realtor and lender who are experienced housing experts in your market of interest and who you trust to give sound advice. To cut costs, that could mean some buyers would need to move further away from higher-priced cities into more affordable metros.

And higher interest rates will cause your monthly payment to go up as well. When interest rates rise, banks tend to make more in earnings from the higher rates that they can charge on loans, so their stock prices may rise in anticipation. This index measures stock performance of the 500 largest companies listed on US stock exchanges.

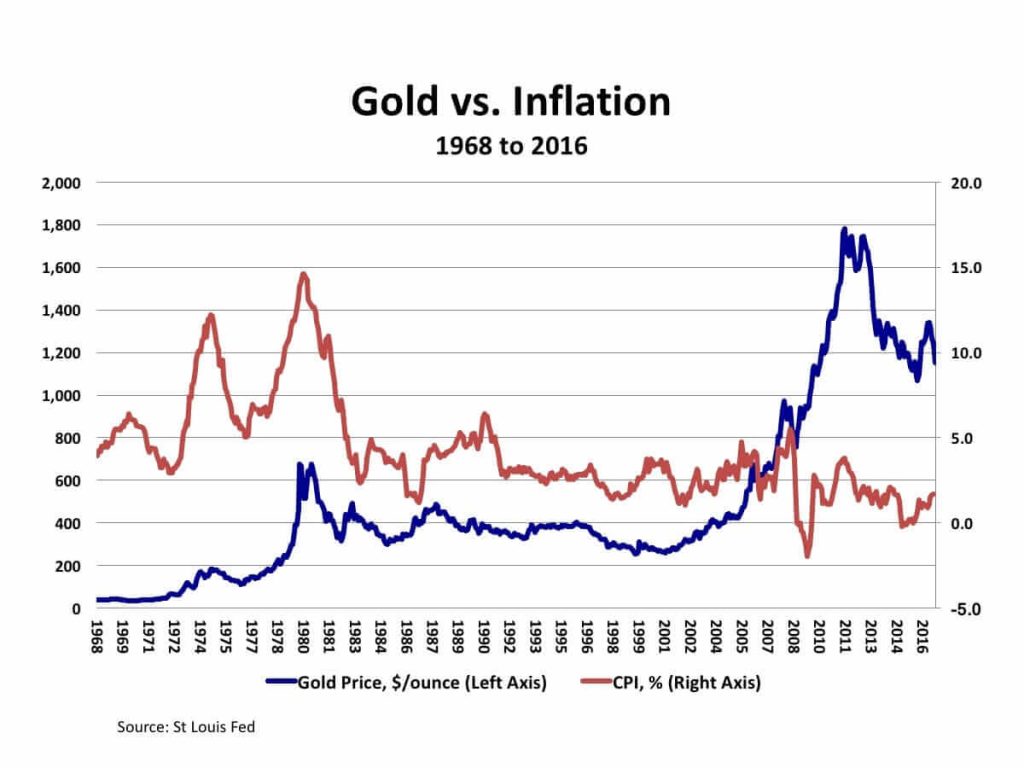

However, when you consider interest rates from a historical perspective, you can see that rates are still low in comparison. Why did stocks tumble after the Fed did pretty much exactly what the market thought it would? It's not about today's rate hike, according to one investment strategist. It's because the Fed signaled in its economic projections that more rate increases are coming than investors anticipated due to persistent inflation...which isn't falling as quickly as hoped. Mortgage interest rates determine the rate at which interest will be charged to a mortgage.

No comments:

Post a Comment