Table of Content

Skiba noted that investors also were disappointed by the fact that the Fed is now saying that interest rates could end next year at 5.1%...higher than the 4.6% projection in September. Powell said the Fed won't cut rates until inflation falls to 2% "in a sustained way." "Generally, companies want to hold on to the workers they have, because it's been very, very hard to hire," Powell said. "You have all the vacancies far in excess of the number of employed people. It doesn't sound like a labor market where a lot of people need to be out of work."

Experts are forecasting that the 30-year, fixed-mortgage rate will vary from 4.8% to 5.5% by the end of 2022. Is calculated by averaging interest rate information provided by 100-plus lenders nationwide. Compare the national average versus top offers on Bankrate to see how much you can save when shopping on Bankrate. A housing unit, as defined for purposes of this report, is a house intended for occupancy as separate living quarters. Housing units, as distinguished from "HUD-code" manufactured homes, include conventional ``site-built'' units, prefabricated, panelized, componentized, sectional, and modular units. To be included in the sales estimates the sales transaction must intend to include both the house and the land.

Compare current mortgage rates for today

Each point, which is also known as a discount point, costs 1 percent of the mortgage amount. The average, or arithmetic mean, sales price is obtained by dividing the sum of all the sales prices reported by the number of houses reporting a sales price. The median sales price is the sales price of the house which falls on the middle point of the total number of houses sold.

Always consider factors such as HOA fees and the option to pay down your mortgage if you must move quickly. Most home buyers who use a mortgage loan to finance their purchase will need to put down a certain percentage of the sale price. When a buyback aligns with a company’s long-term plan, and the company can cover their operational expenses, it can support the stability and growth of the company. When stock prices are volatile, companies can repurchase shares when they are undervalued.

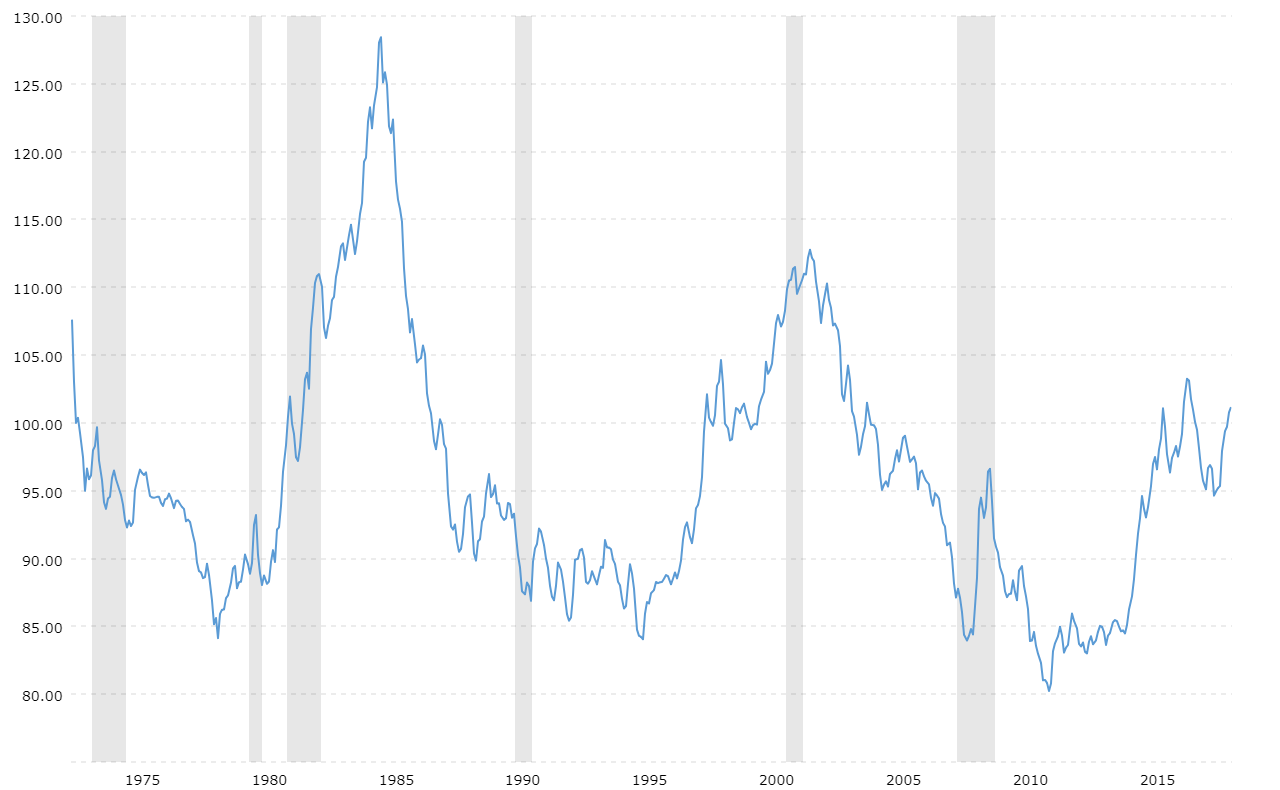

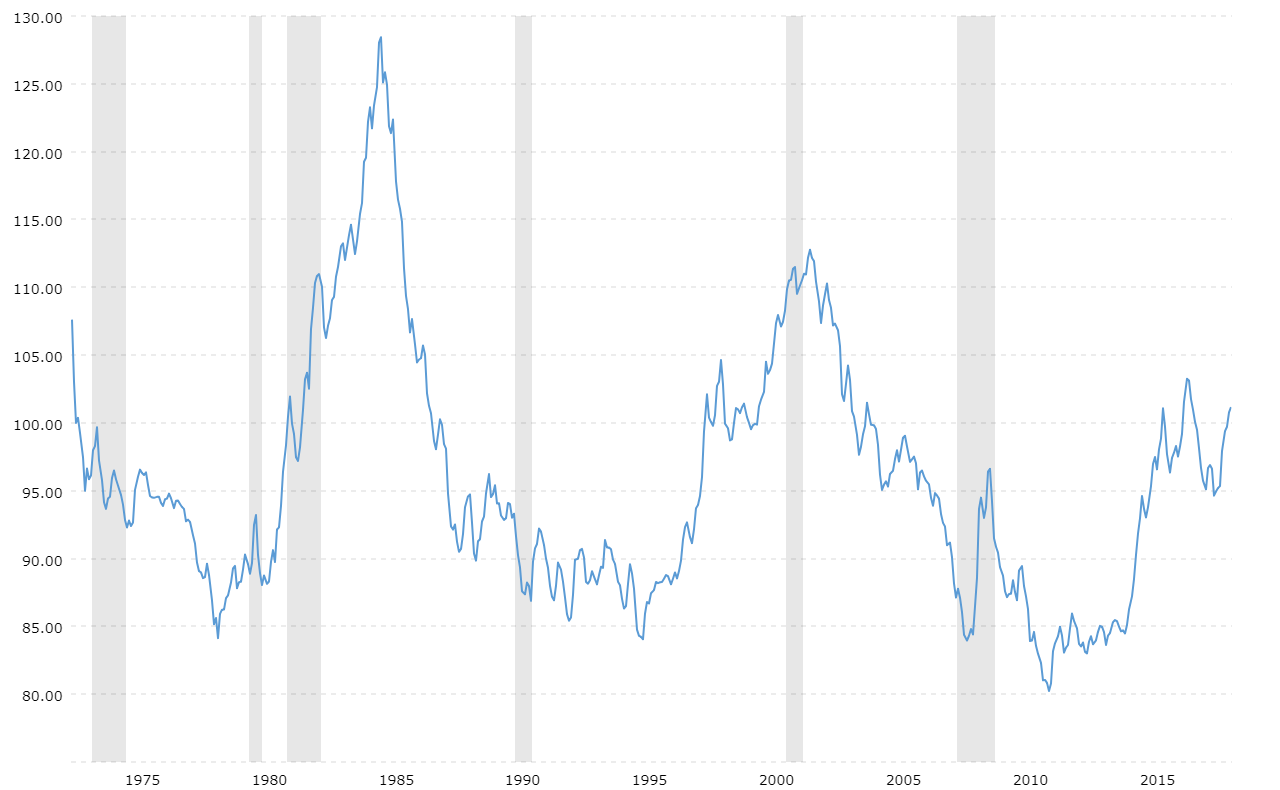

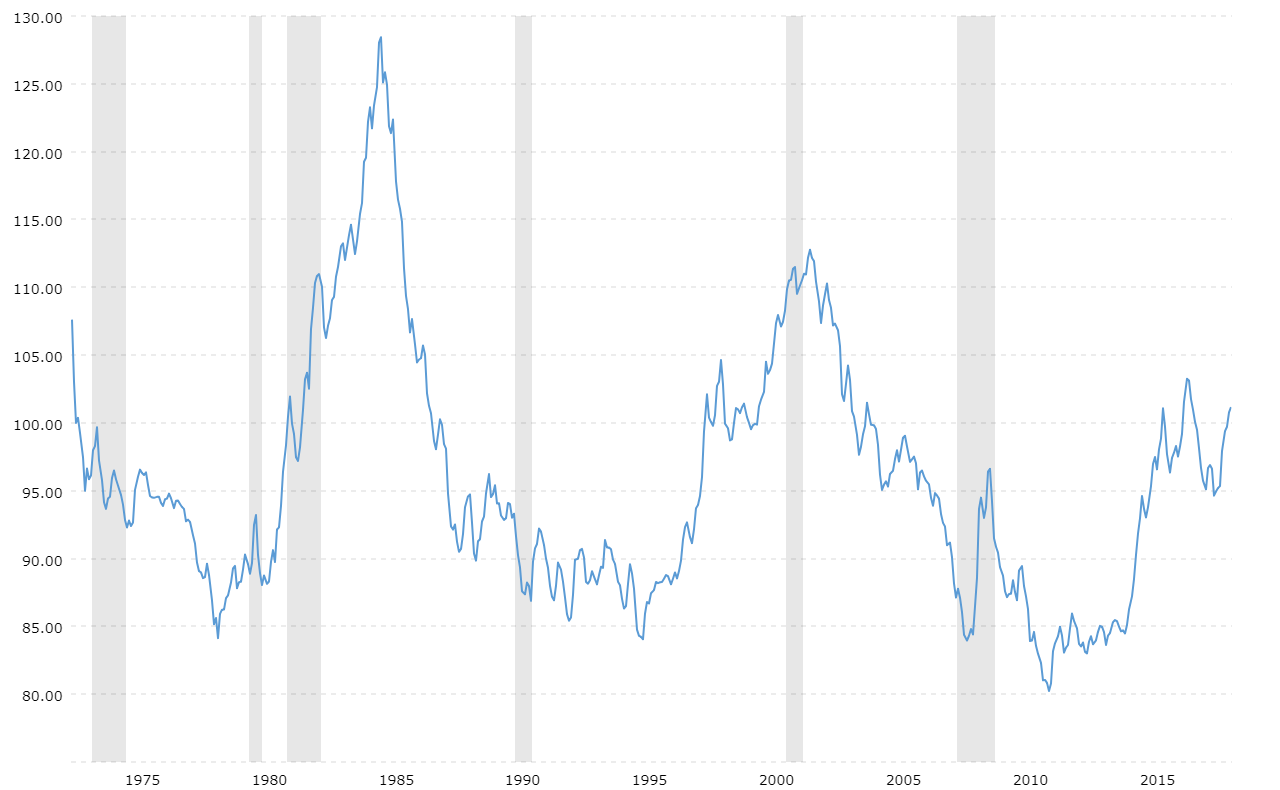

Mortgage Rate Trends

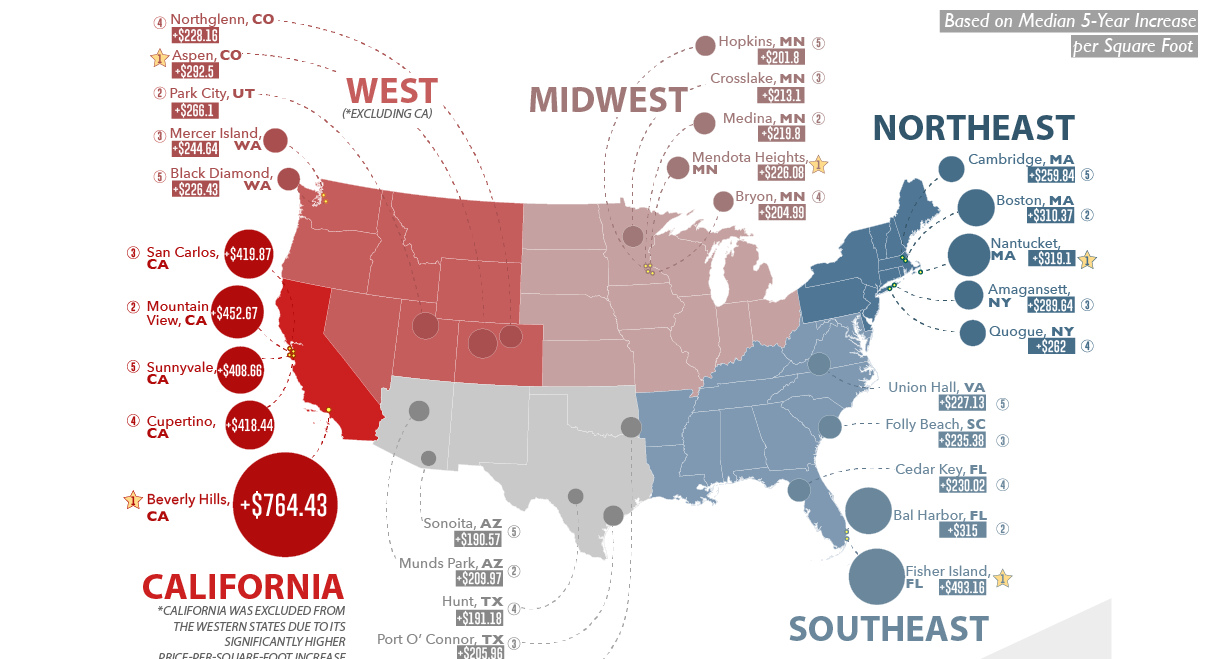

Each of them has been accompanied by a deceleration in house price growth. Determining whether it is better to have lower closing costs or a lower interest rate will come down to the exact numbers and math. Generally, the best option is what results in the total overall cost of your home purchase being less. Typically, this would be a lower interest rate, as you will pay that interest rate over a long period of time if you don't refinance. This can result in lower monthly costs and lower overall interest paid on the mortgage. Rising mortgage interest rates are nothing to fear and knowledge of the topic will ease housing market participants’ anxiety.

Because home values have risen sharply in the last few years, it’s also possible that a refinance could free you from paying for private mortgage insurance. If you’re eligible for a USDA or VA loan, you won’t need to put any money down. Keep in mind that mortgage rates change daily, even hourly, based on market conditions, and can vary by loan type and term. To ensure you’re getting accurate rate quotes, compare loan estimates based on the same term and product, and aim to get your quotes all on the same day. You should also ask about maximum fees and which factors determine rate hikes and decreases. Always seek out information about HOA fees on all the homes you are considering.

Apply for a mortgage today!

Ultimately, the best time to buy a house is when you feel you’re ready to do so. Yet unlike the last two recessions in 2008 and 2020, buybacks have shown notable strength in 2022 in spite of falling share prices. In this way, when share prices decline, buybacks typically decrease. In fact, in the third quarter of 2022, an estimated one in five companies in the S&P 500 Index conducted buybacks that in turn increased their earnings per share by at least 4% year-over-year. In this Markets in a Minute from New York Life Investments, we chart the growth of buybacks over the last two decades and the implications for investors looking ahead.

The average APR fell on a 30-year fixed mortgage today, slipping to 6.78% from 6.83%. Meanwhile, the average APR on the 15-year fixed mortgage sits at 6.07%. This same time last week, the 15-year fixed-rate mortgage APR was at 5.97%. Although some lenders offer a free rate lock for a specified period, after that period they may charge fees for extending the lock. With a fixed-rate mortgage, you know your principal and interest costs won’t change. Mortgage broker fees – Brokers can help borrowers find a better rate and terms, but their services must be paid for when the loan closes.

Rising Interest Rates and Homebuyers

Changes to bank rates can cause volatility, which means there’s often opportunity to trade around the changing prices of stocks. If interest rates are higher and stock prices are falling, this could present opportunity for traders who think the price will ultimately rise again over time. An ARM index is what lenders use as a benchmark interest rate to determine how adjustable-rate mortgages are priced. You can check rates online or call lenders to get their current average rates. You’ll also want to compare lender fees, as some lenders charge more than others to process your loan.

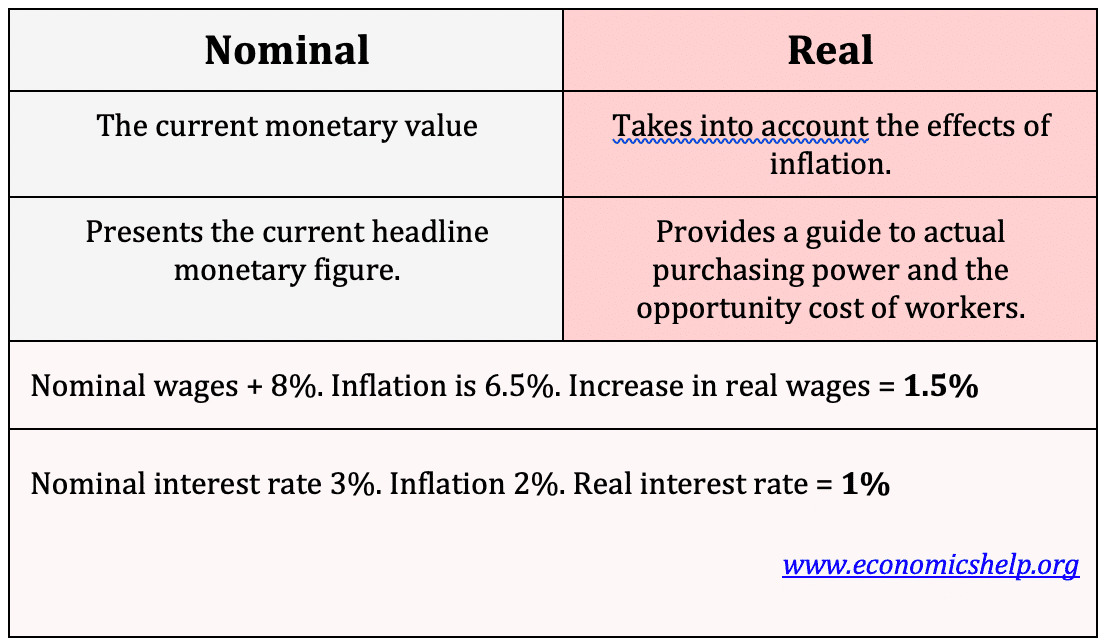

You can also see that this study says most other studies have concluded there is very little to no correlation between interest rate changes and housing prices. I think the more telling sign is from the 1980s and 1970s where interest rates rose to astronomical highs! It is important to know that the first graph is not what mortgage rates were. Mortgage rates that people get on their houses are not directly tied to the prime rate. For the week of Oct. 9, 1981, mortgage rates averaged 18.63%, the highest weekly rate on record, and almost five times the 2019 annual rate. A lot of the correlation during the period might just be the move to stable price controls since Paul Volker considering the entire period has roughly seen decreasing mortgage rates.

And if mortgage rates rise, home prices might have to come down back down to earth. The home price, your down payment and interest rate will affect how much your monthly mortgage payment is. If you buy a more expensive house, your monthly payment will be higher.

Conventional loans are often ultimately bought by Fannie Mae or Freddie Mac, the big government-sponsored enterprises that play an important role in the mortgage lending market. They are offered by virtually every type of mortgage lender, with some programs allowing for a down payment as low as 3 percent. A conventional loan can be either conforming or nonconforming; the conforming loans are the ones backed by the GSEs. The type of mortgage loan you use will affect your interest rate.

But would the lower payment help you if you didn’t have an extra $4,000 for a larger down payment? The difference in the down payment could eliminate the possibility of buying the home you want or knocking you out of the buyer’s market altogether if you can’t find a cheaper neighborhood. This can mean being able to afford a little bit more house than you might in a higher rate environment.

It is also important for buyers to be conscientious of what their down payment will come up to. Having a down payment within their bracket can mean the difference between what neighborhood they end up in or if they can even afford to buy a house. It is arguable, however, that interest rates don’t matter too much. As long as a homeowner can consistently afford their payments, there should be no problem. According to the National Association of Realtors , experts have predicted that the economy will bounce back post-pandemic. Remember that volatility creates opportunity, but it also heightens risk, so it’s important that traders adhere closely to their risk management strategies and trading plan.

Manage Your Mortgage

Applying for a mortgage on your own is straightforward and most lenders offer online applications, so you don’t have to drive to an office or branch location. Additionally, applying for multiple mortgages in a short period of time won’t show up on your credit report as it’s usually counted as one query. Lending has become increasingly more costly for homeowners and borrowers alike as mortgage rates continue to rise. Mortgage rates jumped 1.5 percentage points during the first three months of the year, the biggest quarterly climb in 28 years. Treasury bond yields, rising inflation and the Federal Reserve’s monetary policy indirectly influence mortgage rates. As inflation increases, the Fed reacts by applying more aggressive monetary policy, which invariably leads to higher mortgage rates.

No comments:

Post a Comment